Market analysis is an essential component of any successful business strategy. It provides valuable insights into the current market conditions and helps businesses make informed decisions. However, with the vast amount of data available, it can be overwhelming to determine which metrics are the most important to consider. In this article, we will discuss some key metrics that should be included in your market analysis. 1. Market Size and Growth Rate Understanding the size of the market you are operating …

Blog Posts

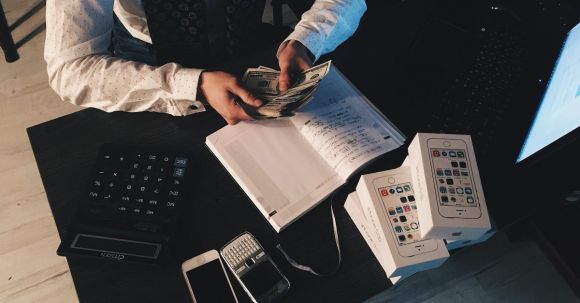

Investing in stocks can be a lucrative way to grow your wealth, but it also comes with its fair share of risks. With thousands of stocks to choose from, how can you ensure that you make profitable investments? One key tool that can help you make informed decisions is financial analysis. By analyzing a company's financial statements and other relevant data, you can gain valuable insights into its financial health and make smarter investment choices. In this article, we will …

The stock market is a complex system that is influenced by a myriad of factors. Understanding these key factors can help investors make informed decisions and navigate the volatile nature of the market. In this article, we will delve into some of the most important factors that influence stock market performance. Economic Indicators One of the primary factors that impact the stock market is the state of the economy. Economic indicators such as gross domestic product (GDP), employment data, inflation …

In the fast-paced world of stock market investing, it is crucial for investors to have a solid understanding of the companies they are investing in. This is where fundamental analysis comes into play. Fundamental analysis is a method of evaluating a company's financial health and prospects by examining its financial statements, management, industry, and overall economic factors. It is a key tool for investors to make informed decisions and maximize their returns in the stock market. Understanding the Basics of …

In today's competitive business landscape, effective market analysis plays a crucial role in making informed decisions and staying ahead of the competition. To conduct a comprehensive market analysis, it is essential to utilize the right tools. In this article, we will explore some of the essential tools that can help businesses gain valuable insights and make strategic decisions. 1. Market Research Surveys Market research surveys are an invaluable tool for collecting data directly from consumers and target audiences. Surveys can …

In the world of investing, one of the most crucial tasks is to assess the value of a stock. While there are various methods and strategies to determine the worth of a company's shares, financial analysis stands out as a reliable and effective approach. By analyzing a company's financial statements, investors can gain insights into its performance, profitability, and overall financial health. In this article, we will explore how financial analysis can be used to assess stock valuations. Understanding the …

The stock market is a complex and dynamic system that is influenced by a multitude of factors. One of the most significant factors that drives the stock market is trade. Trade plays a crucial role in shaping the fortunes of companies, determining stock prices, and influencing investor sentiment. In this article, we will explore the different ways in which trade impacts the stock market. Trade and Company Performance The performance of a company is directly linked to its ability to …

The stock market can be a complex and volatile place. Prices of stocks can fluctuate wildly, and it can be difficult for investors to navigate these markets successfully. However, by understanding stock market trends, investors can gain valuable insights into the direction of the market and make more informed investment decisions. In this article, we will explore what stock market trends are and how investors can use them to their advantage. What are Stock Market Trends? Stock market trends refer …

Investing in the stock market can be a profitable venture, but it can also be risky if you don't know what you're doing. To maximize your chances of success, it's important to have a solid understanding of the market and to approach your investments with a clear strategy. In this article, we'll provide some valuable tips to help you navigate the stock market and make informed investment decisions. Do Your Research Before you start investing, it's crucial to do your …

Market volatility can be both exhilarating and nerve-wracking for traders. It refers to the rapid and significant price fluctuations that occur in financial markets. Understanding market volatility is crucial for making informed trading decisions. In this article, we will delve into the concept of market volatility, its causes, and strategies to navigate through it. What is Market Volatility? Market volatility is a measure of the rate at which the price of a financial instrument or market index changes over time. …

Insider trading has long been a controversial practice in the world of finance. It refers to the buying or selling of a company's stocks by individuals who have access to non-public information about the company. This practice is illegal as it gives those insiders an unfair advantage over other investors. In this article, we will explore the effects of insider trading on company stocks. The Basics of Insider Trading Insider trading occurs when company insiders, such as executives, directors, or …

The stock market has always been an exciting and lucrative place for investors. However, the way people trade stocks has changed dramatically over the years, thanks to the evolution of online trading platforms. In this article, we will explore the journey of online trading platforms and how they have revolutionized the stock market. The Rise of Online Trading Platforms In the past, investors had to rely on traditional brokerage firms to buy and sell stocks. This process was often slow, …

In the ever-changing world of finance, understanding market trends is crucial for making informed investment decisions. By analyzing these trends, investors can identify opportunities and allocate their resources in a way that maximizes returns. In this article, we will explore the importance of analyzing market trends and discuss how investors can use this information to optimize their investment allocations. Identifying Market Trends Before delving into investment allocation, it is essential to identify and understand market trends. Market trends can be …

Investing in the stock market can be a lucrative endeavor, but it also comes with its fair share of risks. To mitigate these risks and make informed investment decisions, it is essential to analyze financial data. By examining key financial metrics and trends, investors can gain valuable insights into a company's financial health and make more informed decisions about buying or selling stocks. In this article, we will explore the importance of analyzing financial data and highlight some key factors …

The world of stock portfolio management can be a complex and daunting one. With so many factors to consider, it can often feel overwhelming to make informed investment decisions. However, by analyzing market data, investors can gain valuable insights and improve their portfolio management strategies. In this article, we will explore the importance of market data analysis and how it can be used to enhance stock portfolio management. Understanding Market Data Before delving into the analysis of market data, it …

In today's competitive business landscape, market analysis plays a crucial role in understanding the dynamics of a particular industry. It helps businesses identify opportunities, evaluate their competition, and make informed decisions to drive growth and profitability. However, conducting an effective market analysis requires careful consideration of several key factors. Let's delve into these factors and understand their significance. Market Size and Growth Potential One of the first factors to consider in market analysis is the size and growth potential of …

Financial analysis is a vital tool that helps businesses and investors make informed decisions about their finances. It involves assessing the financial health and performance of a company by analyzing its financial statements and other relevant data. In order to conduct an accurate and comprehensive financial analysis, there are several important factors that need to be taken into consideration. This article will discuss these factors in detail, providing valuable insights for anyone involved in financial analysis. 1. Revenue and Sales …

Market analysis is a crucial component of any business strategy. It provides valuable insights into consumer behavior, trends, and competition, enabling businesses to make informed decisions. However, the true value lies in the ability to identify opportunities that can lead to growth and success. In this article, we will explore key strategies for identifying opportunities in market analysis. Understanding Consumer Needs and Preferences The first step in identifying opportunities is to gain a deep understanding of consumer needs and preferences. …

Investing in the stock market can be a daunting task for many individuals. With thousands of companies to choose from and constantly changing market trends, it is essential to have the right information to make informed investment decisions. This is where stock market analysts play a crucial role. They are experts in analyzing the financial performance of companies and providing valuable insights to investors. In this article, we will explore the role of stock market analysts and how their recommendations …

The stock market can be a daunting place for investors, with its unpredictable nature and constant fluctuations. However, by employing the right strategies and analyzing market data effectively, investors can make more informed decisions and increase their chances of successful investments. In this article, we will explore some key aspects of analyzing stock market data that can help investors make better investment choices. Understanding Market Trends One of the first steps in analyzing stock market data is to identify and …